We make refinancing debt easier and fairer

Refinance debt 100% online in a matter of minutes.

01

Fewer debts, less hassle

Roll multiple debts into one, so you only have to deal with one interest rate and one repayment schedule.

02

Get sorted faster

Refinancing high-cost credit like credit cards and store cards can help you break free from the debt spiral.

03

Lower your interest payments

With our fair, personalised interest rates, you may qualify for a better rate than you’re currently paying.

Won't affect your credit score.

Customers (and counting!)

100% online

Our AI-driven quote process is 100% online.

No paperwork, no queues and no need for awkward face-to-face meetings.

Super fast

Simply tell us about yourself and your finances and accept the terms to get funded in minutes

Rates tailored to you

Interest rates are based on your individual credit assessment - not one-size-fits-all.

What we offer

-

Loan amount

$2,000 - $100,000

-

Interest rate from²

7.99% - 24.99% p.a.²

-

Establishment fee

$150

-

Repayment frequency

Weekly, fortnightly, or monthly

-

Loan type

Unsecured

-

Loan terms

3, 5 or 7 years¹

-

Early repayment fee

$0

-

Rate type

Fixed rate

-

Lightning FAST funding

Typically less than 5 minutes

-

Get your money fast

No queues and no need for awkward face to face meetings.

How to apply

01

Get to know you

Tell us about the personal loan you want, then provide us with some details about yourself and your finances.

02

Get your quote

We’ll give you a detailed quote with your interest rate, borrowing limit and repayments.

03

Get your money

After accepting the terms and providing some final details, most people receive their money in less than 5 minutes after loan acceptance.

Won't affect your credit score.

Lightning FAST ⚡

Instant quotes, zero paperwork

Our AI-driven quote process is 100% online and paperwork-free. Get answers in seconds, so you can keep moving forward.

$2,000 to $100,000

Our unique AI will assess your needs and finances to offer you an affordable personal loan that suits your lifestyle.

Personalised for you in a flash

Our smart technology tailors your quote instantly – just answer a few questions, and let AI do the rest.

Lightning fast approvals

Get a quick quote in minutes and in most cases loans are funded in less than 5 minutes. It’s that easy!

Consolidate debt today

Taking control of your debt is the first step to healthier finances.

Won't affect your credit score.

How customers rate us

4.8 out of 5 stars - based on 39,798 reviews

-1.avif)

4.8

37,009 Reviews

4.7

173 Reviews

4.7

2,616 Reviews

Frequently asked questions

How much can I borrow to buy my vehicle?

You can request anywhere from $2,000 up to $100,000, subject to your affordability and credit profile.

Do I need a deposit or trade-in?

No deposit or trade-in is needed! You can finance up to 100% of the cost of your vehicle, making it easier to shop like a "cash" buyer.

Can I buy from a private seller?

Yes, you can! Harmoney has no restrictions on where you purchase your vehicle, so both dealerships and private sales are acceptable.

Can I use a Harmoney loan to pay off my loan from the vehicle dealer?

Absolutely. Once your loan is approved, you can use the funds to pay off your old loan and enjoy a new fixed rate with no early repayment fees.

What are my loan options when applying for a vehicle loan?

When you get a quote, you can choose between a secured and an unsecured loan. The choice is yours. A secured loan typically has a lower interest rate because the vehicle acts as collateral.|

Learn more about interest rates.

Can I use my loan to buy any type of vehicle?

For an unsecured loan, you can purchase any type of vehicle, such as cars, motorbikes, trucks, buses, and vans. However, for a secured loan, you can only purchase a car or a motorbike.

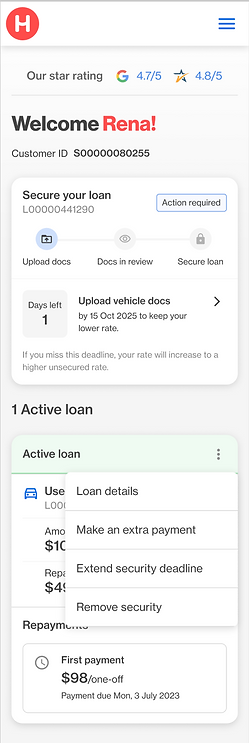

How long do I have to secure my loan?

From the day your funds are disbursed into your account, you have 60 days to buy your vehicle and secure your loan. If you don't secure your loan within 60 days, it will convert to an unsecured loan, which carries a higher interest rate.

What do I need to do to secure my loan?

- Enter into your loan contract and receive your money.

- Buy a vehicle within 60 days. This vehicle will then serve as security for your loan, allowing you to enjoy your lower interest rate.

- Complete the vehicle details form from your dashboard.

- is in your name;

- is with a reputable insurance company;

- has comprehensive cover for the vehicle's full value or a minimum of $10,000, whichever is greater; and

- names “Harmoney Australia Pty Ltd” as an interested party.

IMPORTANT

If you don't buy a vehicle and complete the vehicle details form within 60 days, your rate becomes a higher unsecured rate.

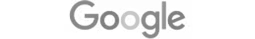

Where can I find my VIN or chassis number?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

In most cars, you can find your VIN printed on the driver’s side interior dashboard otherwise you will be able to find it in one of the below locations.

Can I extend my deadline to secure my loan?

Yes. If you need more time, you can extend your deadline by 30 days. This option becomes available 10 days before your current deadline, and you can only extend once. To do this, simply log in to your dashboard and select “Extend security deadline”.

What happens if my security details cannot be verified?

If your vehicle does not meet our eligibility criteria or we do not receive the required documents, we will not be able to use your vehicle as security, and your loan will revert to an unsecured loan, at a higher interest rate.

What happens if I want to sell my vehicle after I take the loan?

Unsecured Loan If you have an unsecured loan, your vehicle is not tied to the loan agreement. This means you can sell your vehilce at any time without needing to notify us or gaining our permission. The loan remains in place as a personal loan, and your repayment schedule continues as originally planned.

Secured Loan A secured loan uses your vehicle as collateral. This means the loan is secured against the vehicle, and we have a financial interest in it until the loan is fully repaid. If you want to sell the vehicle, you have two options:

- Pay off the loan: You can pay the remaining balance of your loan in full. Once the loan is paid off, the security registration over your vehicle is released, and you are free to sell it. We do not charge any fees for an early repayment.

- Remove the vehicle from the loan: If you’d like to sell your vehicle but keep your loan, you can apply to have the security registration over your vehicle released early. Once approved, we’ll remove the vehicle as security within 1–2 business days. After 20 days, your loan will automatically switch to an unsecured loan with a higher interest rate.

Eligibility Criteria

To get a quote in New Zealand;

You must be 18 years or older.

You must be a New Zealand citizen, Permanent Resident or Australian citizen.

Your credit file must not have any defaults, judgments or bankruptcies.

You must have paid employment (which may include self-employment).

You need to borrow at least $2,000 with your loan.

You need to have photo identification documents such as your valid Australian passport or driver’s to licence, to hand.

If you are not eligible now, you may be in the future.